When analyzing the economic landscape, it is crucial to move beyond the surface-level data and delve into the sub-components that provide a more nuanced understanding of the situation. For instance, while economists may predict a slight decrease in the Michigan Inflation Expectations Index, there is an anticipated increase in the Michigan Consumer Expectations Index. These sub-components shed light on different aspects of the economy and can significantly impact investor sentiment.

In light of recent developments such as the US jobless claims figures and scheduled speeches by FOMC members like Michelle Bowman, Austan Goolsbee, and Michael Barr, investors are advised to closely monitor market trends. The discussions surrounding the US economy, inflation rates, and the Fed’s stance on interest rates can potentially sway market dynamics. Factors such as Bank of Japan chatter and US consumer sentiment trends further contribute to the volatility in the market.

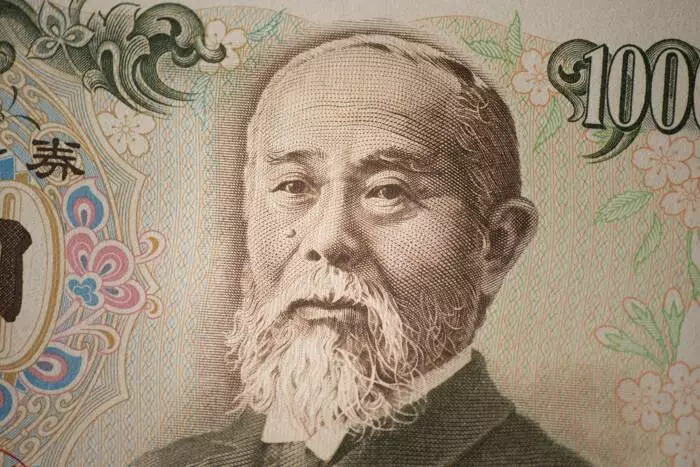

The USD/JPY pair remains a focal point for investors, with various technical indicators pointing towards potential price movements. The currency pair has displayed resilience by staying above both the 50-day and 200-day Exponential Moving Averages (EMAs), signaling a bullish trend. A potential breakout towards the 158 level could pave the way for further gains, with the April 29 high of 160.209 serving as a target. However, a downward trend could materialize if the USD/JPY falls below key support levels, such as the 50-day EMA and the 151.685 support level.

In navigating the complex economic landscape, investors must consider a myriad of factors ranging from central bank policies to consumer sentiment trends. By staying abreast of market developments and conducting in-depth analyses of economic indicators, investors can position themselves strategically to capitalize on emerging opportunities. While short-term trends may be influenced by specific events, a comprehensive understanding of long-term economic trajectories is essential for making informed investment decisions.

Leave a Reply