China recently reported data that indicated slower growth in retail sales, with only a 2.3% increase in April compared to the previous year. This figure fell short of the expected 3.8% increase, signaling a potential slowdown in consumer spending. The pace of growth was also slower than the 3.1% reported in March, which raises concerns about the overall health of the economy.

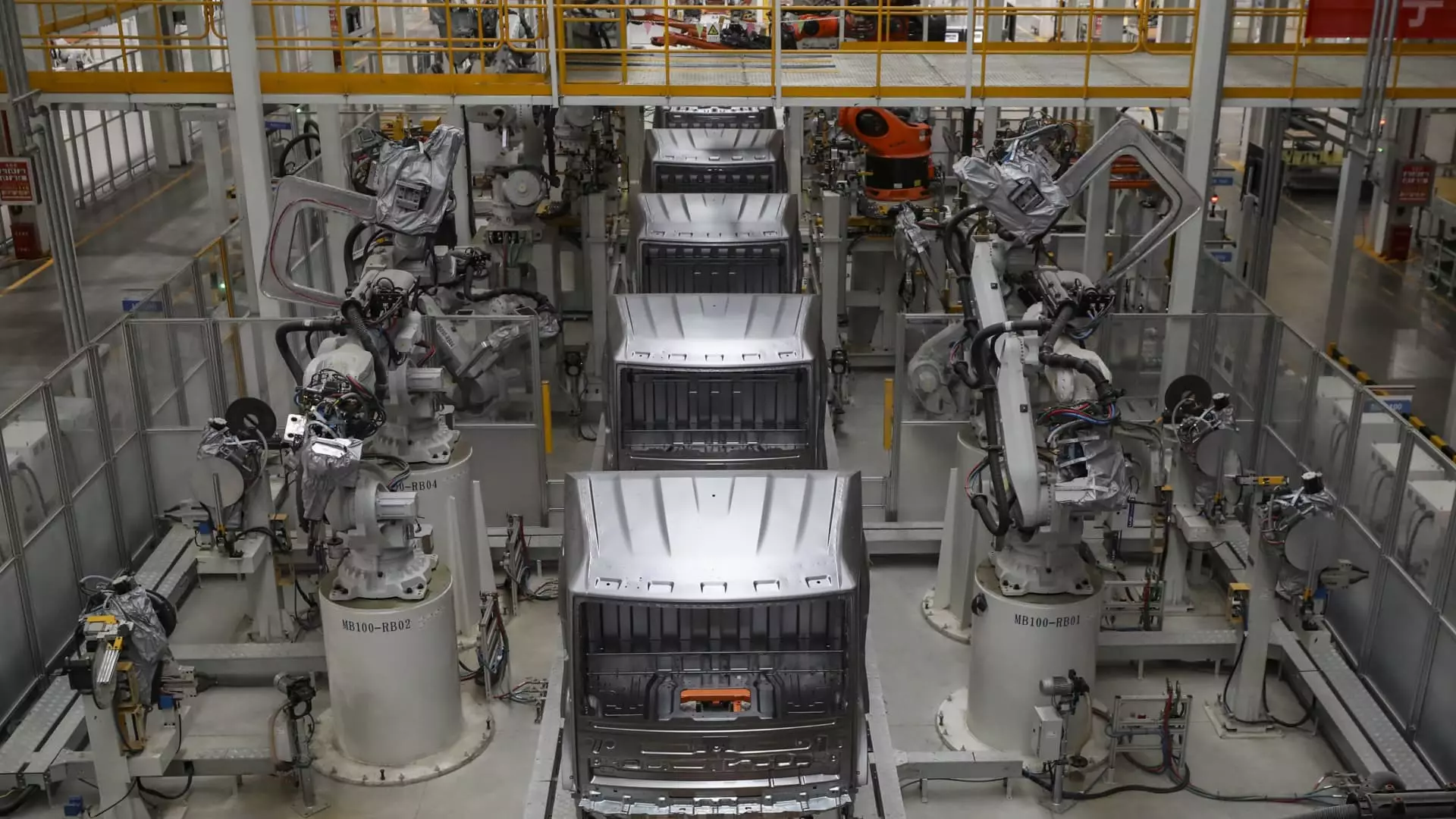

Robust Industrial Activity

In contrast to the sluggish retail sales figures, industrial production in China remained robust, with a 6.7% increase in April from a year ago. This growth beat expectations for a 5.5% increase and was a significant improvement from the 4.5% growth reported in March. Despite the positive outlook for industrial activity, the disparity between consumer spending and industrial production points to a growing economic divide.

Fixed asset investment only rose by 4.2% for the first four months of the year, lower than the expected 4.6% increase. Real estate investment also saw a steep decline, down 9.8% year-on-year. Infrastructure and manufacturing investment slightly slowed their pace from March levels, indicating a cautious approach from investors. The urban unemployment rate in April stood at 5%, further highlighting the challenges facing the economy.

The statistics bureau attributed the fluctuations in April figures to the Labor Day holiday in May and the high base from last year’s data. Liu Aihua, a spokeswoman for the bureau, noted that the timing of the holiday affected the year-on-year comparison. The real estate sector continues to be in a period of adjustment, with challenges persisting despite efforts to stimulate growth.

While some indicators point to a mixed picture for growth, the issuance of ultra-long bonds for funding strategic projects could provide a boost to the economy. China’s official GDP grew by 5.3% in the first quarter, surpassing expectations and setting a target of around 5% GDP growth for 2024. The EU Chamber of Commerce in China remains optimistic about the outlook, emphasizing the need for increased domestic demand to sustain growth.

Dan Wang, chief economist at Hang Seng Bank (China), anticipates the stabilization of China’s property market by the end of next year. While the real estate sector faces challenges, industrial investment and manufacturing have demonstrated resilience in supporting the economy. Wang acknowledges the impact of government policies on curbing speculation in the housing market but remains confident in the overall strength of the Chinese economy.

China’s economic data reflects a complex landscape of growth and challenges. While retail sales may be slowing down, industrial activity remains a bright spot in the economy. With strategic investments and policy measures, China aims to navigate through the current uncertainties and achieve stable growth in the coming years.

Leave a Reply