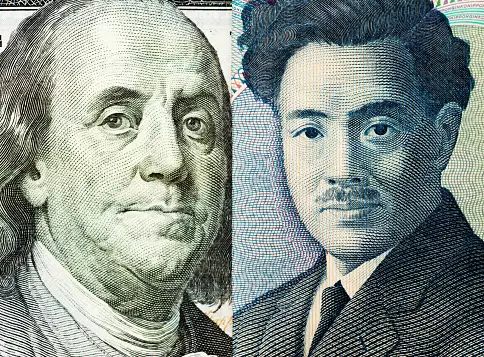

The recent weakness of the yen against the US dollar has raised concerns among Japanese officials, prompting warnings against the possibility of excessive volatility in the currency market. The Bank of Japan has intervened in the past to prevent the yen from strengthening beyond the psychological mark of 160 yen per USD, as it is deemed unacceptable. This intervention usually leads to temporary effects, with the market quickly readjusting itself in a matter of months.

The interest rate differential between Japan and the US has been a driving force behind the upward trend of the USD/JPY chart, as indicated by technical analysis. The chart shows that the rate is currently in an upward trend, marked in orange, moving from the lower to the upper half of the blue channel. The 158.20 level is identified as a potential support level, given its history as a former resistance point reinforced by the median of the blue channel.

There is a possibility that the USD/JPY rate could surpass the multi-month peak of April, leading to a reaction from the Bank of Japan. The central bank has already discussed reducing bond purchases and raising rates in response to the increasing volatility in the currency market. Yen weakness not only impacts imported inflation but also puts pressure on the Bank of Japan to unwind its ultra-loose policy.

Traders have the opportunity to take advantage of the current market conditions by trading over 50 forex markets 24 hours a day with FXOpen. With low commissions, deep liquidity, and spreads from 0.0 pips, opening an FXOpen account provides access to a wide range of trading opportunities. It is important to note that the opinions expressed in this article are solely those of the Companies operating under the FXOpen brand and should not be considered as financial advice or a solicitation for trading products and services.

Leave a Reply