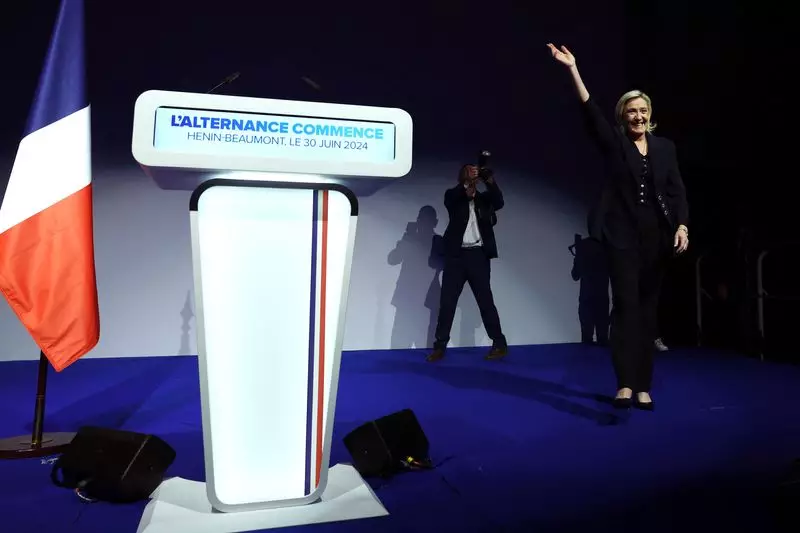

The recent first round of France’s parliamentary elections saw Marine Le Pen’s far-right National Rally party emerge victorious. Exit polls indicated that while the RN won the first round, the final outcome will be determined by further negotiations in the run-off next week. The euro experienced a slight increase of 0.23% following the announcement, with European markets feeling the impact of President Macron’s decision to call the snap election on June 9. Both far-right and leftwing wins pose challenges for investors due to their promises of significant spending increases, which could further strain France’s delicate financial situation.

Peter Goves, the Head of Developed Market Debt Sovereign Research at MFS Investment Management, London, highlights the uncertainties surrounding the seat projections due to the emergence of three-way contests. While a hung parliament remains a prevalent scenario, the impact on the markets may not be as adverse as initially anticipated. Fiona Cincotta, a Senior Markets Analyst at City Index, London, notes that the margin of victory for Le Pen was smaller than expected, contributing to a sense of relief in the markets. However, the focus now shifts to the second round on July 7 for a clearer picture of the majority support.

David Morrison, a Senior Market Analyst at Trade Nation, London, anticipates a protest against Macron and a positive outcome for RN, with concerns raised about the implications of the uncertain vote percentage and its impact on France and the euro. Michael Brown, a Senior Strategist at Pepperstone, London, acknowledges that the election results may not be as detrimental as feared, with potential strategies from other parties to prevent RN’s success in the run-off. Despite the prevailing uncertainties and risks, the market remains cautious and prepared for a range of potential outcomes.

Philip Shaw, the Chief Economist at Investec, London, underscores the ambiguity surrounding the seat distribution due to the electoral system, emphasizing the need for further analysis of the first round results. The possibility of cohabitation between a National Rally government and Macron presents additional uncertainties for the economic and political landscape in France. Carsten Brzeski, the Global Head of Macro at ING, Frankfurt, points out the elevated levels of uncertainty in the markets following the election results, setting the stage for a period of heightened volatility.

The outcome of Marine Le Pen’s National Rally victory in France’s parliamentary elections has triggered a wave of speculation and uncertainty in the financial markets. As investors navigate through the complexities of coalition-building and policy implications, it is crucial to exercise caution and vigilance in assessing the evolving situation. The weeks ahead are likely to be characterized by heightened volatility and market reactions, underscoring the importance of a thorough understanding of the implications of these election results on the broader economic landscape.

Leave a Reply