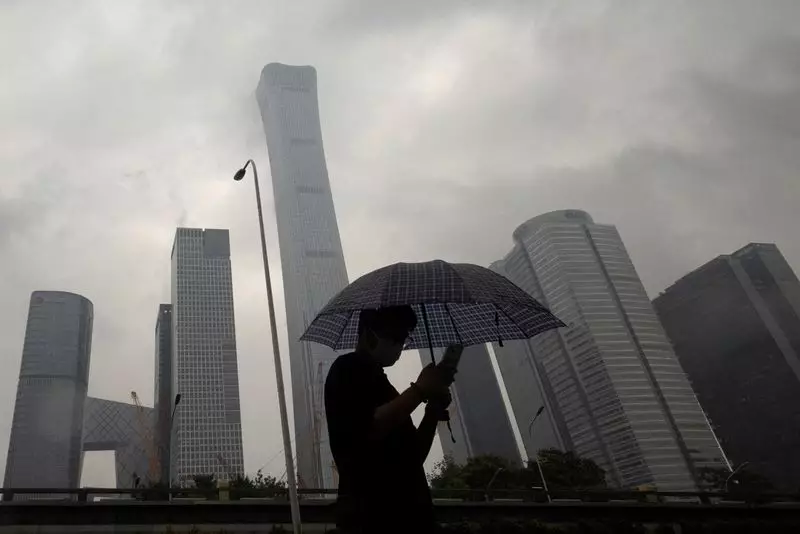

As Asian markets gear up for Thursday’s trading session, investors find themselves on the defensive. The recent slide on Wall Street has cast a shadow over positive global inflationary figures reported earlier. Key economic and policy highlights for the region on Thursday include the Indonesian central bank’s policy decision, consumer price inflation and trade figures from Hong Kong, as well as producer price inflation data from South Korea. The downward trend in UK inflation last month took the markets by surprise and increased the consensus that major central banks will have ample room to cut interest rates in the coming year. A surge in US consumer confidence to a five-month high initially fueled a global risk rally before a sharp reversal in the last hour of trading on Wall Street, leading to a significant decline in world stocks. If this negative sentiment spills over into Asia on Thursday, it is likely to exacerbate the long-standing underperformance of emerging and Asian markets, particularly in China.

Asian markets, including Chinese markets, have struggled to keep up with the global risk rally. The Shanghai blue chip CSI 300 index experienced a decline of over 1% on Wednesday. In fact, it is heading for its sixth consecutive weekly loss, marking its worst weekly streak in 12 years. Additionally, it is on track for its fifth consecutive monthly loss. The market faces significant challenges, such as the encroaching threat of deflation, the implosion of the vast property sector, and a questionable growth outlook. These factors have contributed to the market’s underperformance compared to other regions.

Unlike its regional counterparts, Hong Kong has experienced a notable rise in consumer price inflation. In October, consumer price inflation reached a year-high of 2.7%, with the month-on-month rate also rising to a two-year high of 1.0%. Economists are cautiously waiting for the figures to be released on Thursday, expecting annual inflation to remain stable at 2.7% in November. While inflationary concerns persist in Hong Kong, the diverse market dynamics pose a potential opportunity for investors.

The Role of Bank Indonesia

Bank Indonesia is expected to maintain its benchmark seven-day reverse repo rate at 6.00% for the second consecutive month. Inflation has remained within the bank’s target range of 2% to 4% for the past six months, and the rupiah has witnessed a nearly 2% gain since the unexpected rate hike in October. This has alleviated pressure on imported prices, allowing Bank Indonesia to adopt a cautious approach. Economists polled undoubtedly predict that the first rate cut will occur in the third quarter of 2024. However, given the well-behaved inflation, the rupiah’s positive momentum, and the Federal Reserve’s forthcoming interest rate cut, Bank Indonesia may opt for a more proactive stance before the predicted schedule.

As Asian markets prepare for Thursday’s trading session, the prevailing sentiment is one of caution and a defensive stance. The recent market volatility experienced in global markets, following the positivity of the global risk rally and subsequent reversal, has cast a long shadow. If this negativity permeates Asia, the underperformance of emerging and Asian markets, notably China, is likely to persist. Coupled with ongoing concerns surrounding deflation, a struggling property sector, and a questionable growth outlook, Asian markets face significant headwinds.

Thursday’s trading session in Asian markets poses challenges and potential opportunities for investors and analysts alike. The recent slide in global markets and the uncertainty surrounding inflation and central bank policies have heightened market volatility. As the day unfolds, investors will closely monitor updates from the Indonesian central bank, consumer price inflation and trade figures from Hong Kong, and producer price inflation data from South Korea. Amidst these developments, it remains critical for market participants to adopt a cautious and critical stance while navigating the ever-changing landscape of Asian markets.

Leave a Reply