The Australian Dollar has shown potential for advancement following the release of RBA Minutes which suggest that current cash rates will remain unchanged for an extended period of time. This indicates stability in the Australian economy, potentially leading to an increase in the value of the Australian Dollar. RBA’s decision not to cut rates in the near future is likely to boost investors’ confidence in the currency.

On the other hand, the US Dollar is expected to receive support from caution ahead of the release of the FOMC Minutes. The CME FedWatch Tool indicates that the market is now pricing in a 67.5% chance of a 25 basis points Fed rate cut in September, down from the previous 76%. This change in sentiment could strengthen the US Dollar as investors anticipate a more stable economic outlook.

The Chinese economy plays a significant role in influencing the Australian markets due to their close trade partnership. China’s new approach to boosting its real estate market by permitting local governments to use special bonds for purchasing unsold properties could have implications for the Australian economy. Any changes in the Chinese economy could potentially impact the Australian Dollar and the overall market sentiment.

Federal Reserve officials’ statements have also influenced market movements. Minneapolis Fed President Neel Kashkari’s suggestion of potential US interest rate cuts in September due to concerns about a weakening labor market could weigh on the US Dollar. Federal Reserve Bank of San Francisco President Mary Daly’s emphasis on a gradual approach to reducing borrowing costs and Federal Reserve Bank of Chicago President Austan Goolsbee’s warning about restrictive policies could create uncertainty in the market.

The AUD/USD pair is currently trading around 0.6750 with a bullish bias. The daily chart analysis shows an upward trend within an ascending channel, indicating a potential for further gains. However, the 14-day Relative Strength Index (RSI) suggests that the pair may be nearing overbought levels, which could lead to a correction. Key levels to watch for include a possible test of the seven-month high at 0.6798 and support around the lower boundary of the ascending channel at 0.6670.

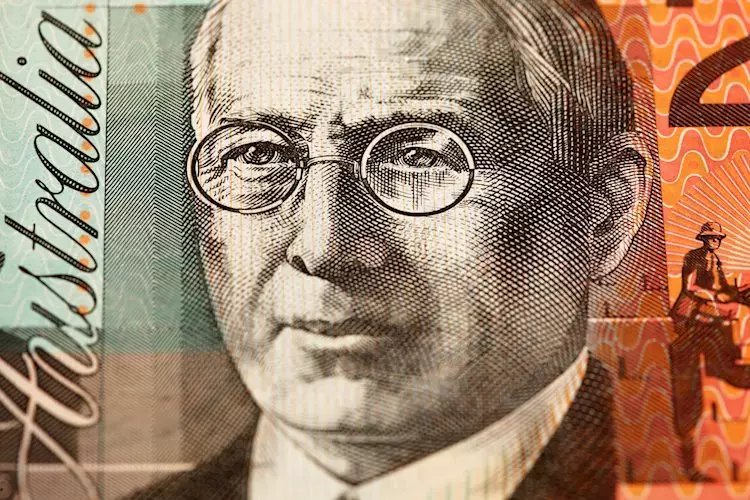

The table below shows the percentage change of the Australian Dollar against listed major currencies, with the strongest performance noted against the New Zealand Dollar. This data provides insights into the relative strength of the Australian Dollar in comparison to other major currencies. The heat map visualizes the percentage changes of major currencies against each other, offering a clear picture of the currency movements in the market.

The Federal Open Market Committee (FOMC) plays a crucial role in determining the US interest rate policy. The release of FOMC Minutes provides valuable information on the future direction of US interest rates, guiding investors in their decision-making process. By reviewing economic and financial conditions, the FOMC assesses the risks to long-run goals of price stability and sustainable economic growth, shaping the overall monetary policy stance.

Various factors such as central bank decisions, economic data releases, and geopolitical events contribute to the movement of currencies in Australia and the US. Understanding these influences and conducting thorough analysis can help investors navigate the volatile foreign exchange market with greater confidence and insight.

Leave a Reply