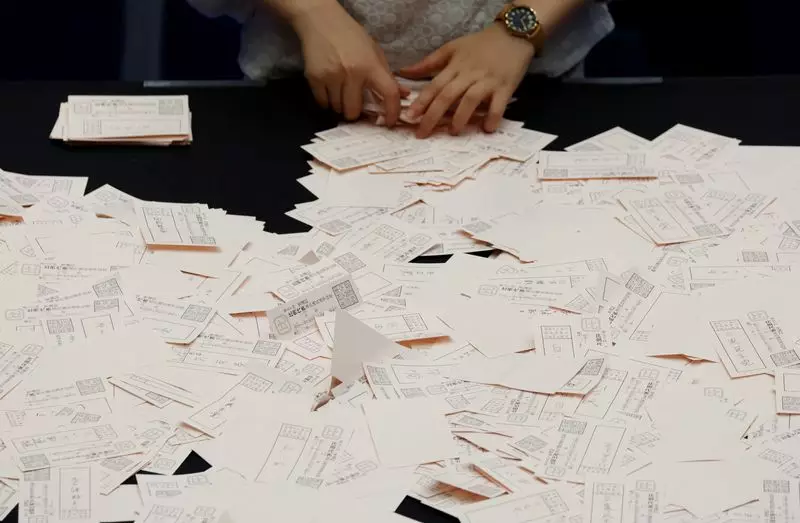

As the sun rose on a new trading week in Asia, investors found themselves facing a storm of uncertainty and potential volatility. The catalyst for this tension was the recent parliamentary election in Japan, wherein Prime Minister Shigeru Ishiba’s Liberal Democratic Party (LDP) lost its government majority. This outcome represents a significant shift in Japan’s political landscape, stirring apprehension among market participants who have long relied on the LDP’s consistency in governance. The initial response is anticipated to be unfavorable, particularly for the Japanese yen and domestic equities, with speculation of a potential sell-off looming.

The sell-off, if it materializes, could exacerbate existing fears regarding regional and global market stability. Analysts have often maintained that the durable political structure in Japan is essential for the effective execution of monetary policy by the Bank of Japan (BOJ). With the BOJ’s next interest rate decision on the horizon, the implications of this political upheaval could extend far beyond Japan’s borders, influencing the strategies of investors worldwide.

The ramifications of political instability in Japan cannot be understated, particularly in an environment where market stability is paramount. The BOJ’s monetary policy is intricately linked to the country’s economic health, comprising factors such as inflation control and government debt management. A loss of political continuity may hinder the BOJ’s ability to make decisive moves in interest rate policy, potentially causing unease among foreign investors and triggering adjustments in Japanese Government Bond prices.

Additionally, the political backdrop impacts investor sentiment in other critical markets. Key economic indicators, such as the purchasing managers index (PMI) data due to be released this week, are vital to gauging the state of economic activity across Asia, primarily focusing on the Chinese market. However, the crux of the matter rests on whether recent economic stimuli initiated by Beijing have had significant time to influence outcomes. Early indications suggest that it may still be premature to ascertain the long-term effectiveness of these measures.

Against this backdrop of uncertainty, Asia’s market performance has remained lackluster. Recent statistics reveal a 27.1% drop in industrial profits in China year-on-year for September, marking the steepest decline for the year and echoing sentiments of weakened corporate performance. The MSCI Asia ex-Japan index reflects these apprehensive market tendencies, displaying a decline of nearly 2% in the previous week alone—the third consecutive weekly loss. Specific to Japan, the Nikkei 225 index echoed this sentiment with a 2.7% drop, illustrating a retreat of risk appetite ahead of the political election.

In stark contrast, the U.S. technology sector, particularly the Nasdaq index, has staged impressive recoveries, spearheaded by strong earnings reports from tech giants like Tesla. The tech-heavy index has risen consecutively for seven weeks and showcases resilience juxtaposed to the palpable anxieties experienced in Asia. Meanwhile, the Dow Jones and S&P 500 have shown mixed performances, hinting at the underlying challenges plain in the broader economic landscape amid potential shifts in fiscal and monetary policies.

As investors brace for the forthcoming week, the stakes are high with multiple economic indicators and events on the calendar. Beyond the BOJ’s crucial decision on interest rates, markets are set to absorb earnings reports from several prominent U.S. tech firms. The looming U.S. nonfarm payroll release for October is another essential data point that could reshape economic forecasts significantly.

Moreover, the broader strategic finance dynamics in emerging markets have drawn scrutiny, particularly amidst projections of sustained strong performance from the dollar and elevated U.S. interest rates. Analysts express concern that this environment could prove taxing for emerging market assets struggling to find their footing in the current climate.

The landscape is fraught with uncertainty and potential risks, especially for Asian markets grappling with both political and economic turbulence. The evolving dynamics will likely propel investors to adopt a cautious approach as they navigate through anticipated volatility and seek clarity within this complex global economic framework.

Leave a Reply