Warren Buffett’s Berkshire Hathaway has made headlines once again as it scales down its significant stake in Apple Inc., marking the fourth consecutive quarter of reductions in what was once the company’s largest equity holding. At the end of September, Berkshire’s investment in Apple was valued at approximately $69.9 billion, a notable decrease that indicates Buffett sold off around 300 million shares, shrinking his stake by an astonishing 67.2% compared to last year. This trend has raised eyebrows and prompted discussions about the underlying motives as to why Buffett, a long-time admirer of the tech titan, would continue to divest from such a historically successful investment.

The question at hand is not merely about the figures but the potential market dynamics influencing Buffett’s decisions. His journey with Apple began over eight years ago when he ventured into tech investments, a departure from his prior hesitance towards the sector. Analysts have speculated that the reduction of Apple shares could be linked to multiple factors, including the current high valuation of the stock and an overarching strategy to diversify his portfolio. At one point, Apple constituted nearly half of Berkshire’s equity portfolio, a situation that inherently carries substantial risk, prompting the desire for a more balanced investment distribution.

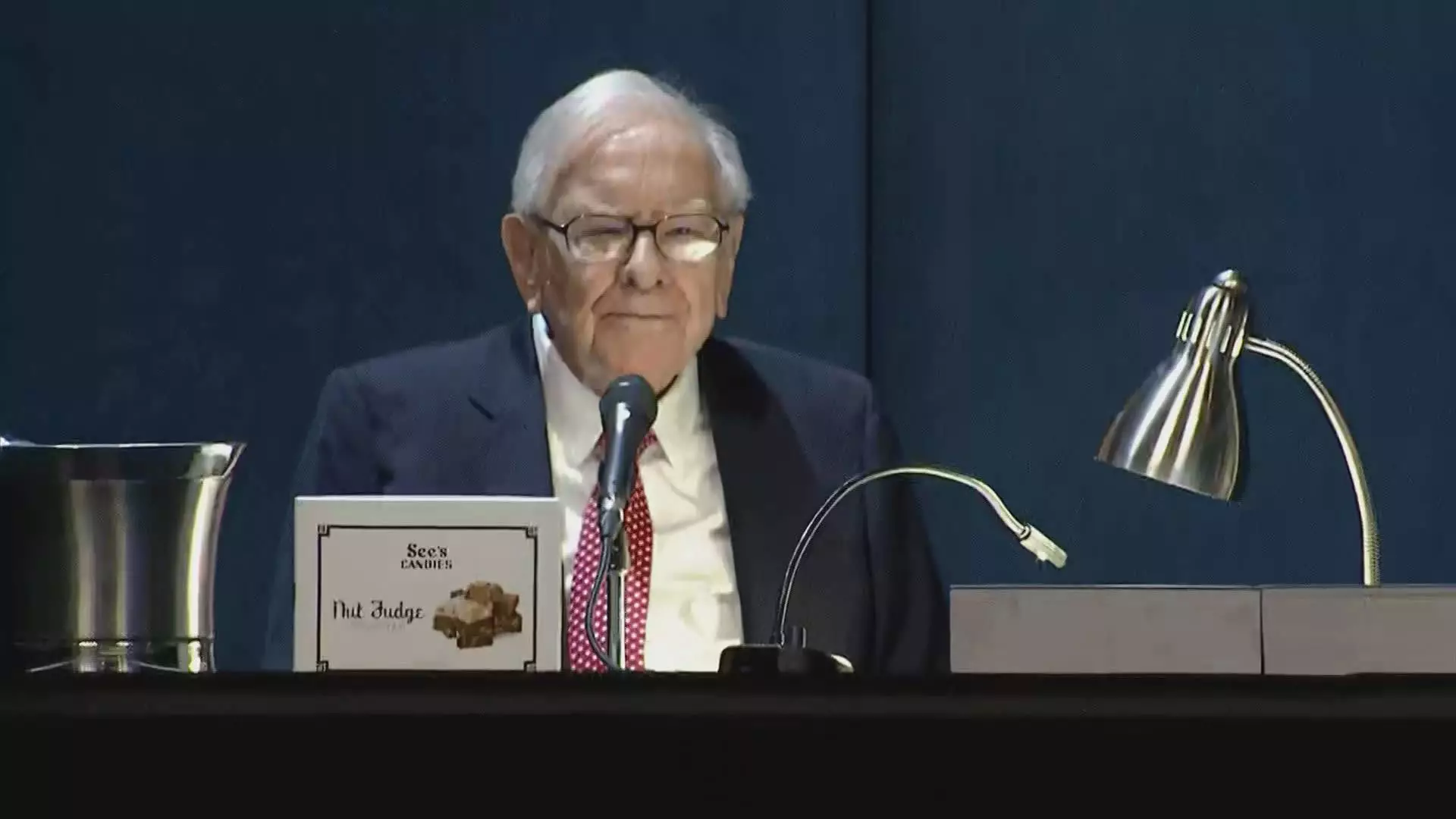

During the Berkshire annual meeting held in May, Buffett hinted at tax-related motivations for his offloading of Apple shares. An anticipated hike in capital gains taxes by the U.S. government in efforts to remedy the growing fiscal deficit may have nudged Buffett to make preemptive moves. However, given the significant volume of the sales, observers speculate that there is more to this narrative than mere tax strategy—possibly a recognition of changing market conditions or an instinctive pivot in investment philosophy.

Buffett’s initial foray into Apple was largely driven by the company’s loyal customer base and the success of its iPhone products. This marked a pivotal shift for Buffett, who had historically refrained from technology investments, claiming they lay outside his ‘circle of competence.’ The affection Buffett developed for Apple positioned it even before his other investments—a factor that makes this current disinvestment noteworthy. During the years, Apple’s role evolved to such a degree that Buffett regarded it as the second-most critical business within Berkshire’s extensive portfolio.

The strategic selling spree has coincided with Berkshire’s cash reserves reaching an astonishing $325.2 billion—a record high for the conglomerate. In the face of these developments, Buffett has notably paused share buybacks during the third quarter, further reflecting a cautious approach amid shifting market sentiment. While Apple shares themselves have shown a 16% increase year-to-date, slightly lagging behind the broader S&P 500’s 20% rise, the implications of Buffett’s actions could resonate throughout the tech investment landscape.

As markets evolve and the economic environment shifts, Buffett’s latest moves will warrant close observation, revealing not only the state of Berkshire’s portfolio but also insights into the overarching philosophies driving investment strategies in a rapidly changing world.

Leave a Reply