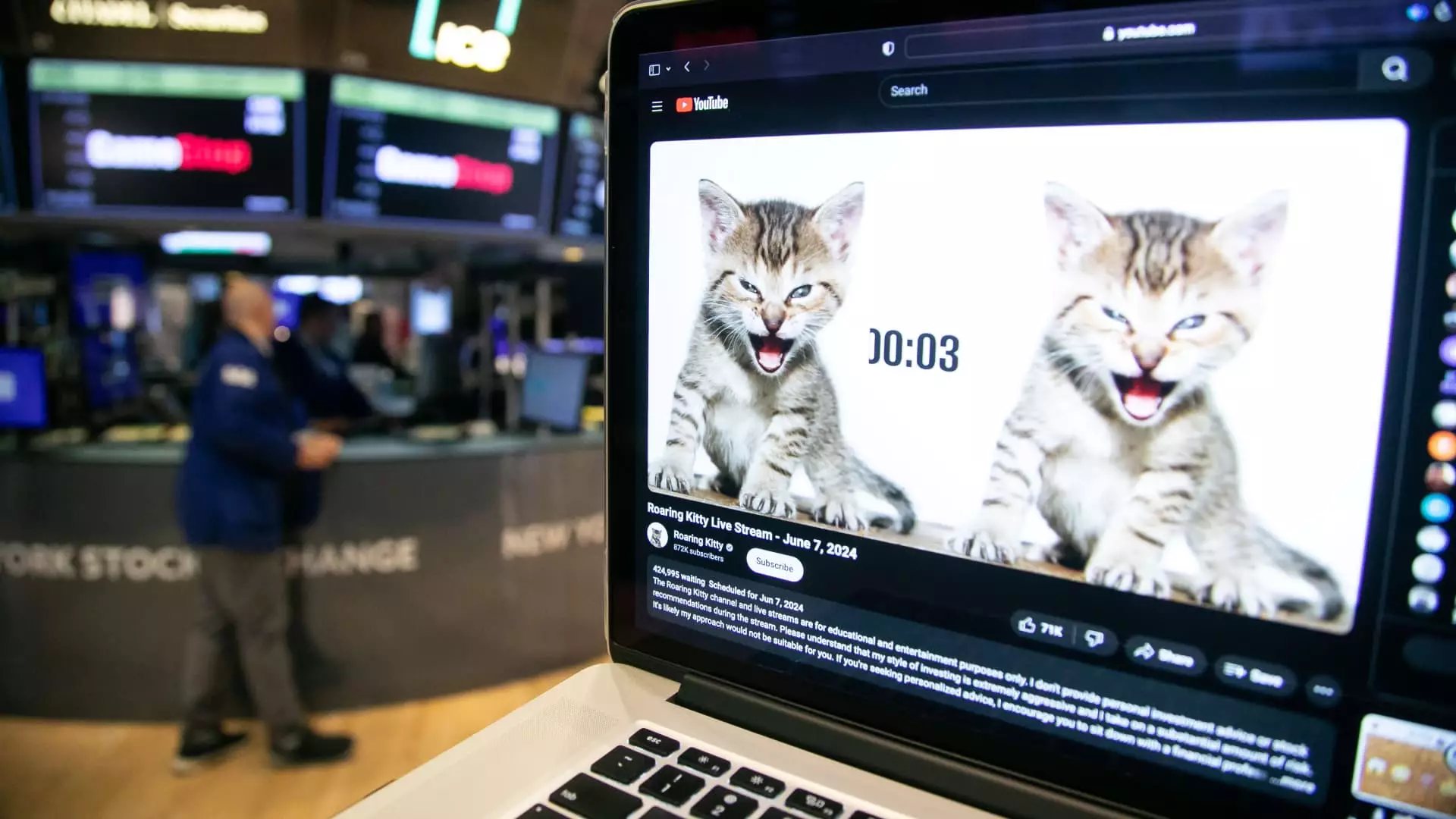

The sell-off in GameStop shares gained momentum during afternoon trading on Wednesday, leading to a significant drop in stock prices. This downward trend coincided with a surge in trading volume in call options owned by meme stock leader Roaring Kitty, also known as Keith Gill. Despite disclosing his portfolio on Monday night, indicating his ownership of 120,000 call options contracts with a strike price of $20 and an expiration date of June 21, the market saw a sharp increase in trading activities for GameStop calls with the same strike price and expiration date.

Options traders speculated that Gill might have to sell his calls before expiration or transition the position into a different call option to avoid the need for a significant cash outlay to exercise them on June 21. Concerns were raised on Wall Street regarding the potential impact of Gill offloading his position on the stock price. The necessity for Gill to have $240 million to acquire the stock (equivalent to 12 million shares purchased at $20 each) raised questions about his financial capacity, as it surpassed the disclosed amount in his E-Trade account.

The surge in trading volume for GameStop calls with the same strike price and expiration date raised speculation about Roaring Kitty’s potential involvement in the market activity. While it remains unclear whether Gill was behind the increased volume, options traders suggested his potential participation, given his substantial holding of the contracts. The price decline of these contracts by over 40% during the trading session, along with the stock’s 16.5% plunge, added further complexity to the situation.

The dynamics of the market, coupled with uncertainties surrounding Gill’s position in GameStop calls, have created a sense of anticipation and anxiety among investors. The potential repercussions of Gill’s actions on the stock price, as well as the broader market sentiment, have led to increased scrutiny and speculation. The need for clarity and transparency in Gill’s trading activities and financial capacity has become a focal point for market observers and participants.

The intensified sell-off in GameStop shares, along with the surge in trading volume in call options owned by Roaring Kitty, has stirred market volatility and speculation. The implications of Gill’s potential actions on the stock price and market dynamics highlight the interconnected nature of trading activities and investor sentiments. As the situation continues to unfold, investors and analysts alike remain vigilant and apprehensive about the broader implications of these market developments.

Leave a Reply