The financial landscape is influenced by a myriad of factors, including central bank decisions, geopolitical developments, and market psychology. The fluctuations in the US Dollar are particularly indicative of broader economic trends and sentiments. Recent events have highlighted a potential shift in market dynamics, especially with the potential implications of monetary policy changes, forthcoming economic data releases, and rising international pressures.

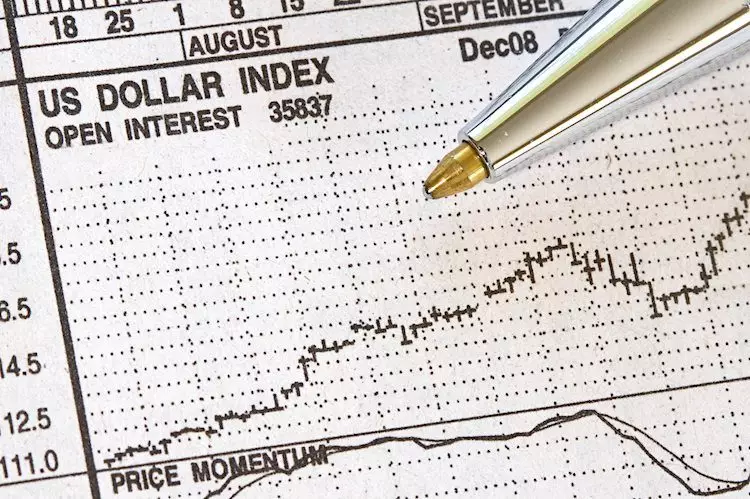

In recent weeks, the US Dollar has experienced notable volatility, particularly marked by a significant rally that now appears to be losing steam. The US Dollar Index (USDX), which measures the value of the dollar against a basket of foreign currencies, reflects this trend. After approaching the pivotal level of 104.00, analysts now caution that a retreat could be imminent as traders recalibrate their expectations in light of new economic developments.

One critical factor contributing to this uncertainty is the response of the Chinese government to its economic challenges. By cutting deposit rates and introducing additional stimulus measures, China is attempting to invigorate its domestic demand and stave off economic decline. This move is significant, as it highlights the interconnectedness of global economies; changes in policy from one major player can have ripple effects across the world, particularly impacting the USD.

In tandem with these developments, the release of housing data from the US Census Bureau is proving to be a focal point for traders and investors. Scheduled for release at 12:30 GMT, the September housing data will offer insights into the state of the US economy, with expectations of a slight decline in both building permits and housing starts. Such indicators often serve as precursors to broader economic trends and may influence Federal Reserve policy decisions moving forward.

In addition to housing data, speeches from key Federal Reserve officials scheduled throughout the day also draw attention. The insights provided by leaders like Raphael Bostic and Neel Kashkari could offer clarity on the Fed’s approach to interest rates and economic stability—critical information for traders navigating this uncertain terrain.

Current expectations regarding interest rates suggest a high probability of a rate cut in the upcoming Federal Reserve meeting, with indications showing a 90.2% likelihood of a 25 basis points reduction. This insight is crucial given the recent developments in the banking sector, where concerns about financial stability heightened expectations for more dovish policies.

The Fed’s stance on interest rates is closely tied to the strength of the dollar; higher interest rates typically bolster the USD as they attract foreign capital seeking better yields. Conversely, the prospect of rate cuts has prompted a reevaluation of the dollar’s strength, particularly as the interest rate gap widens between the US and other major economies, notably the Eurozone.

The Broader Economic Implications amidst Banking Turmoil

This context gains further complexity when considering the fallout from the banking crisis earlier this year, stemming from the vulnerabilities exposed in banks heavily involved in tech and crypto sectors. High-profile insolvencies, triggered by increased withdrawals and discounted assets, have not only unnerved investors but also altered the trajectory of monetary policy discussions.

Before the crisis, expectations pointed towards continued rate hikes to combat inflation; however, the ensuing turmoil caused a rapid shift in sentiment. The crisis effectively changed the narrative on inflation, placing more emphasis on the stability of the banking sector, which subsequently led to a weakening of the USD as market participants adjusted their views on future Federal Reserve actions.

As traders and investors navigate these uncertain waters, the outlook for the US Dollar hinges on a multitude of intersecting factors: the ongoing response to economic indicators, central bank decisions, and geopolitical events. The prospect of further shifts in monetary policy could lead to volatility in the index, with market sentiment playing a pivotal role in dictating the dollar’s trajectory.

For now, a potential resistance point at 103.80 remains critical, as does support at 100-day and 55-day simple moving averages, which could guide traders in either direction. Understanding these dynamics is essential not only for short-term navigation but also for broader investment strategies as the financial landscape continues to evolve in response to both internal and external pressures. Ultimately, the interplay between economic data, central bank policy, and global economic sentiment will dictate how the US Dollar fares in the coming weeks and months.

Leave a Reply