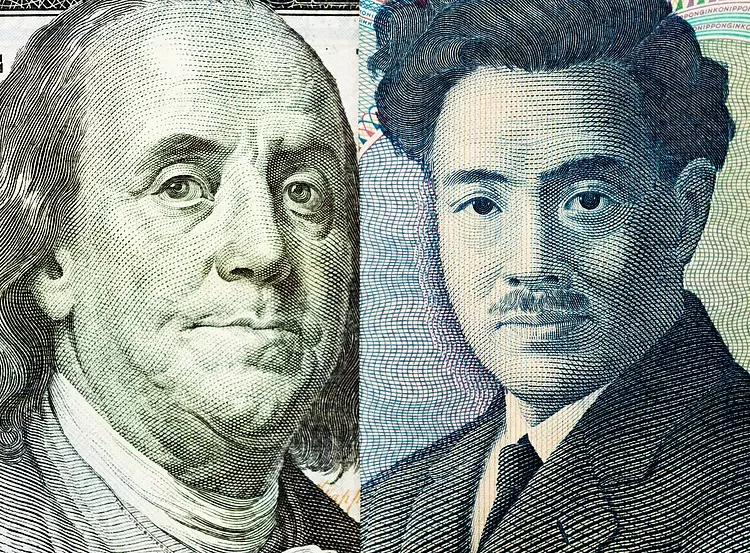

The Japanese Yen seems to be facing significant challenges in the foreign exchange market, as it fails to attract buyers despite fears of intervention and a risk-off impulse. The cautious outlook of the Bank of Japan (BoJ) is one of the main factors that continue to undermine the JPY, while lending support to the USD/JPY pair. This, coupled with the strength of the US Dollar (USD), ensures that the Japanese Yen remains at a multi-decade low, with limited opportunities for a significant recovery.

Despite some attempts by Japanese government officials to defend the domestic currency through jawboning, the risk-off impulse in the market offers some support to the safe-haven JPY. The recent reports of Israeli warplanes bombing Iran’s embassy in Syria have raised concerns about a further escalation of geopolitical tensions in the Middle East. This has tempered investors’ appetite for riskier assets, benefiting the safe-haven status of the Japanese Yen.

Investors have started to lower their bets on a potential Federal Reserve rate cut in June, following positive reports about the US manufacturing sector expanding in March. This news has resulted in the yield on US government bonds climbing to a two-week peak, pushing the US Dollar to a seven-week top. Traders are now closely monitoring the US economic docket, including JOLTS Job Openings and Factory Orders, for any meaningful impetus that could further impact the USD/JPY pair.

From a technical perspective, the recent range-bound price action of the USD/JPY pair could be seen as a bullish consolidation phase. However, traders are advised to wait for a move beyond the multi-decade high around the 152.00 mark before considering any further appreciating move. On the flip side, a decline towards the 151.00 round figure might present a buying opportunity, with resistance levels at 150.85-150.80 and the psychological mark of 150.00.

The Japanese Yen continues to struggle against the US Dollar, despite fears of intervention and geopolitical tensions. The cautious outlook of the BoJ, coupled with positive economic data from the US, has contributed to the ongoing challenges faced by the JPY. Traders should remain vigilant of key economic indicators and geopolitical developments that could further impact the USD/JPY pair in the coming days.

Leave a Reply