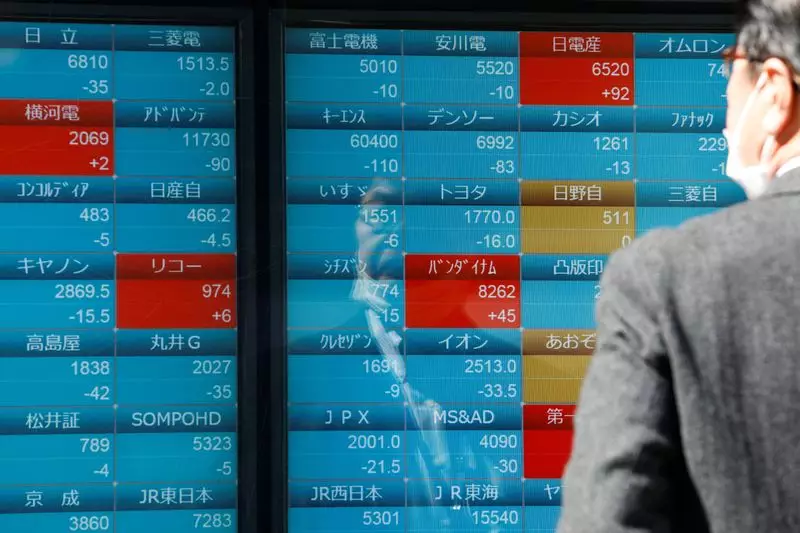

Asian markets experienced a downturn on Thursday as investors grappled with the impact of major economies choosing to adopt a cautious approach towards monetary easing amidst concerns of persistent inflation. The MSCI’s broadest index of Asia-Pacific shares outside Japan dropped by 0.57%, with Australia’s S&P/ASX 200 index witnessing a decline of 0.8%. The reluctance of central banks to hasten the pace of rate cuts raised uncertainties among investors regarding future policy decisions, lending to a bearish sentiment in the market.

In addition to the uncertainties surrounding central bank policies, geo-political tensions also played a role in affecting market sentiments. China’s military initiated ‘punishment’ drills near Taiwan, following the inauguration of Taiwan’s new President, Lai Ching-te. These actions fueled concerns among investors, although Taiwan’s stock market did not exhibit significant fluctuations, remaining relatively stable amidst the tensions.

The release of the Federal Reserve’s minutes from its recent policy meeting, which were more hawkish than anticipated, further added to the market’s unease. The UK also witnessed a high inflation print, while New Zealand’s central bank provided a cautious outlook on inflation concerns. These factors collectively led investors to adjust their expectations regarding the extent and timing of global rate cuts projected for the year.

The technology sector notably saw a positive performance, with Nvidia forecasting quarterly revenue surpassing estimates, resulting in a significant surge in its shares. This news contributed to a slight increase in U.S. futures, with S&P 500 and Nasdaq futures showing gains during Asian trade. The Nikkei in Japan experienced a rise of 0.6%, supported by a weaker yen, while both Sterling and the kiwi maintained near two-month highs against the dollar.

Hong Kong’s Hang Seng Index encountered profit-taking, leading to a 1.5% decline after reaching a nine-month high earlier in the week. Meanwhile, China’s blue-chip index also experienced a slight dip amidst the prevailing uncertainties. Gold prices saw a decrease to $2,372.28 per ounce, slightly retracting from its recent peak, while oil prices also witnessed a decline, with brent crude falling to $81.23 a barrel and U.S. crude edging lower to $76.87 per barrel.

The interplay of central bank decisions, geo-political tensions, and corporate performance has created a complex landscape for Asian markets. The uncertainties surrounding future policy directions and global economic conditions continue to pose challenges for investors, requiring a cautious and strategic approach to navigate the evolving market dynamics.

Leave a Reply