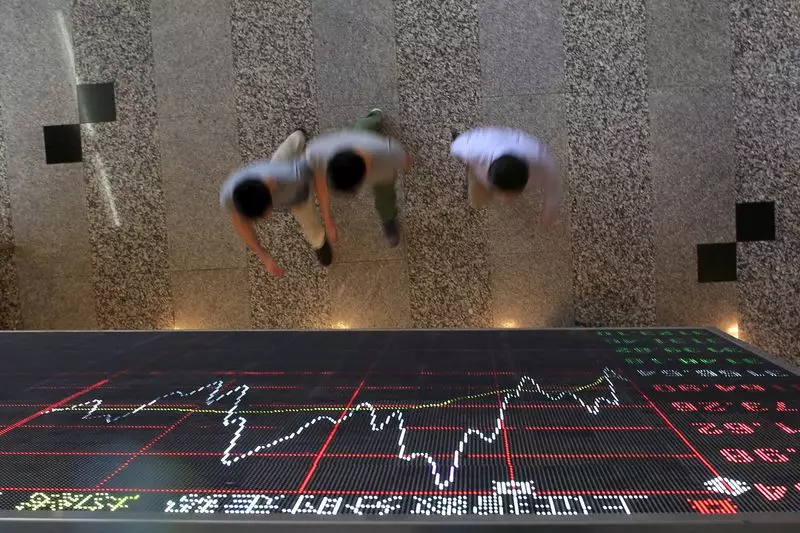

China’s data-driven quant trading funds are rapidly expanding overseas as competition intensifies domestically and regulators tighten their scrutiny over the $260 billion sector. Meridian & Saturn Capital (MS Capital) from Shanghai and Singapore have started offering their China strategy to offshore investors, while also preparing to invest in global markets. DH Fund Management recently set up its first offshore fund, and Beijing-based Ubiquant is planning to open a U.S. office.

The expansion of Chinese quant hedge funds into overseas markets is a strategic move driven by the increasingly crowded and regulated domestic market. The sector has the ability to profit from market volatility in a highly regulated environment. Many Chinese funds are seeking exposure to European and U.S. investors and are in need of building offshore structures to avoid being limited to trading only in China.

Some Chinese quant hedge funds are establishing second investment centers in Hong Kong or Singapore where their strategies can potentially work better and operate more freely due to regulatory constraints in China. This move puts them in direct competition with global giants such as UK-based quant fund managers Winton and Man Group, as well as U.S.-based Two Sigma.

China’s securities regulators recently announced draft rules aimed at enhancing the oversight of program and high-frequency trading. Kate Zhang, CEO of MS Capital, highlighted China’s massive and volatile market as an advantage for quant funds to generate ‘alpha’ or market outperformance. Quant funds rely on program trading to automatically place orders and capture small market fluctuations rapidly.

MS Capital is looking to expand its investment beyond China and introduce global strategies focusing on Asian markets like Japan, India, and Thailand, with plans to eventually venture into European and U.S. markets. Other firms like Minhong Investment from Shanghai are also eyeing global expansion, with strategies targeting Japan and India, and initial testing in the U.S. and South Korea.

The rise of China’s data-driven quant trading funds overseas signifies a shift in focus towards global markets to overcome domestic challenges and regulatory constraints. As Chinese funds aim to build global brands and attract international investors, the competition with established global quant fund managers is expected to intensify. The industry’s ability to adapt to regulatory changes and market dynamics will be crucial in shaping its future success.

Leave a Reply